Donor Advised Funds

A simple, flexible way to support the good work you care about...

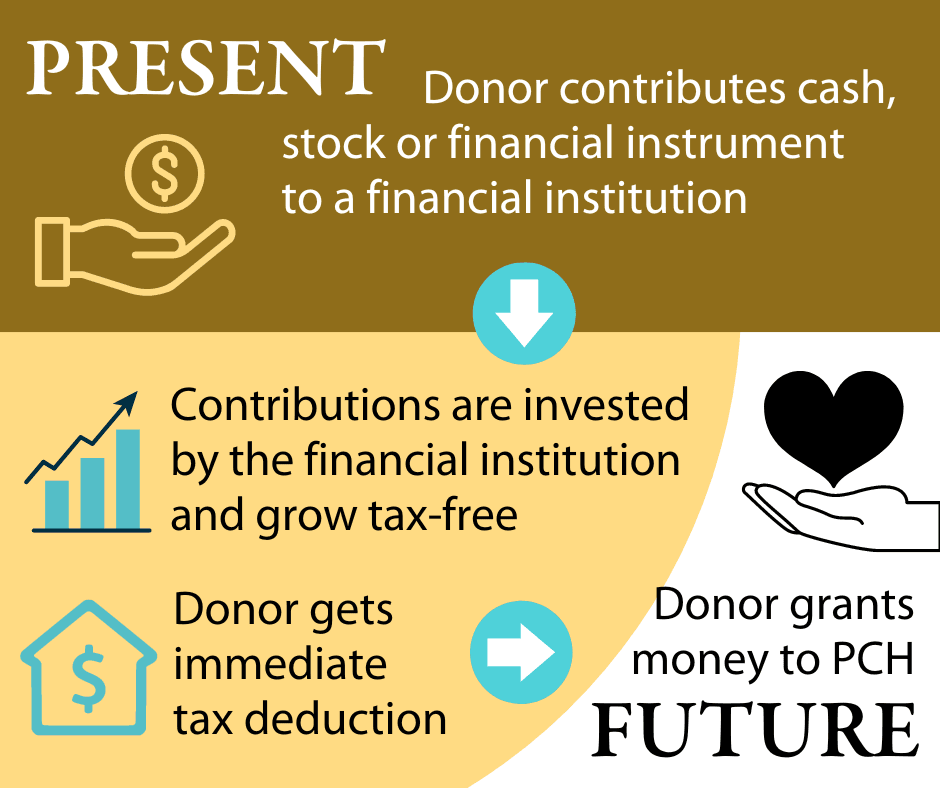

A donor-advised fund is like a charitable investment account, for the sole purpose of supporting charitable organizations cared about by the individual.

Cash, securities, or other assets given to a donor-advised fund at a public charity, like Fidelity Charitable, Schwab or some other institution, enables the individual to take an immediate tax deduction. Then, those funds can be invested for tax-free growth, and the individual can recommend grants to virtually any IRS-qualified public charity.

The DAF is set up at a donor-advised investment firm; it is set up by the individual, not the nonprofit organization. The donor retains the right to advise on which charities should receive distributions.

DAFs are a tax-advantaged donation vehicle, especially useful when significant capital gains or appreciated assets (e.g., stock, mutual funds, and Exchange-Traded Funds/ETFs) are held.

Donors can see significant tax savings when they give to charities through the DAF, instead of donating directly. This is because capital gains taxes can be avoided, in addition to the deduction made for the donation itself. A capital gain is the current, appreciated value of an asset (e.g., stock) minus the original purchase price, which is called the cost basis.

For example, if a stock is currently worth $125 per share, and was purchased five years ago for $25, the cost basis is $25 and the capital gain would be $100. Donating the appreciated stock or cash proceeds to the DAF results in a donor tax deduction for the $125 donation value AND the donor will not have to pay taxes on the $100 capital gain, as they would if they sold the stock on their own, and donated the sale proceeds directly to the charity.

In addition, assets contributed to a DAF are not included in the donor’s estate, so they don’t count toward the total estate value. Thus, investing in DAFs can reduce the size of a taxable estate, increasing the money available to heirs.

To use a DAF for a donation to PCH:

- Set up a DAF account with a financial institution

- Make an initial, irrevocable gift of cash, stock, mutual fund, or ETF to fund the DAF (a minimum amount may be required to open the account).

- The assets in the DAF grow tax-free. Additional funds can be added whenever you desire.

- As long as there are assets in the account, you can make recommendations to the financial institution to give the assets, or cash, to one or more qualified nonprofit charities. Donations can be made anonymously, or not, as you wish.

Currently, Pilgrim Center of Hope is registered with GuideStar, a nonprofit registry. We are a 501(c)(3) non-profit organization.

If you choose a fund that does not have Pilgrim Center of Hope listed, please call us for our Tax ID number and banking information (210-521-3377, Deacon Tom Fox or Ann Gonsalves). Some brokerages give donors the option to sign and submit a transfer request electronically, while others require donors to mail in their transfer requests.

Donor-advised funds are the fastest-growing charitable giving vehicle in the United States because they are one of the easiest and most tax-advantageous ways to give to charity.

For more information, feel free to contact

Ann Gonsalves, Development Coordinator

Office 210-521-3377